David Martínez de Lecea, a Beehive Investor shares his outlook on the advantages of P2P lending vs conventional finance in the current global as well as regional markets

Many potential investors approach peer-to-peer lending (also known as marketplace lending) with an all-or-nothing mentality comparing it with more traditional forms of investing as bank deposits, stocks or even real estate. Bank deposits are safer, stocks are more liquid and real estate is… well, real estate investors just love investing in real estate.

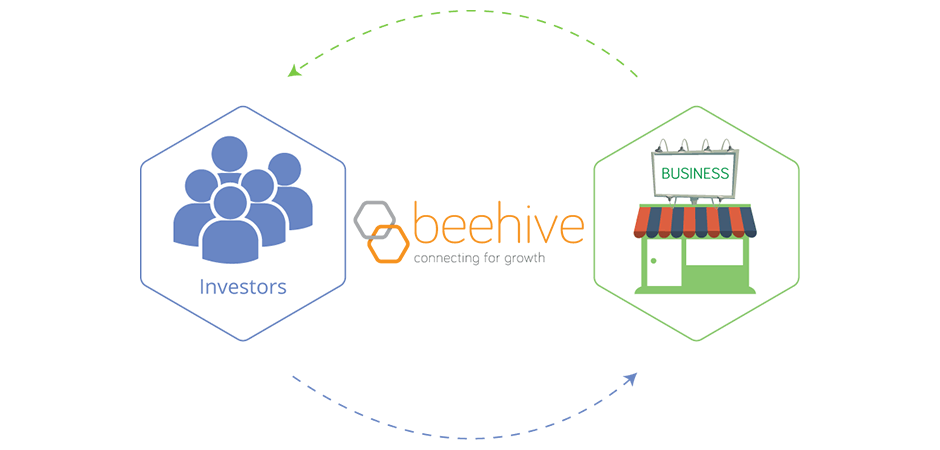

Through these absolute comparisons, one could conclude that lending in a peer-to-peer platform is not a good idea. However, when one looks at it as a component of a balanced investment portfolio the option looks much more attractive. So what is the role of peer-to-peer lending in an investment portfolio?

Firstly, yield. Equity valuations in most markets, especially the US, are showing relatively high valuations which historically has implied much lower expected returns (most analysts expect future 10 year returns to be around 5-10%). Bonds look even grimmer, with central bank interest rates at virtually 0, government bond yields of highly-rated countries are dramatically low or even negative. When interest rates start to rise again, the returns might be even worse. High-yield bonds feel extremely risky due to the raising concerns of illiquidity in that market, aggravated by the closure of redemptions of some big name funds such as Third Avenue’s Focused Credit Fund. The real estate market keeps showing signs of softening or even decline. Bank deposits and savings account offer almost negligible returns. So, taking into account the alternative, the current double-digit returns of peer-to-peer lending look like one of the best options out there.

Secondly, diversification. Regardless of how often financial professionals mention the importance of diversification, many investors keep making the same mistakes again and again. Owning stock of a few or a hundred different American companies is not proper diversification. Even adding government bonds to the portfolio might not be enough. During the 2008 crisis all major asset classes: stock, bonds, real estate… declined simultaneously or, as industry likes to say, all correlations went to one. With capital markets more intertwined every day both by asset class and geographically, the diversification benefits of peer-to-peer lending are truly beneficial.

And finally, beyond pure economic benefits, many people enjoy the thought of knowing that their money is invested in local companies helping the business community of the UAE flourish.

Peer-to-peer lending is becoming a very important and attractive asset class. Investors’ portfolios could substantially benefit from the the returns and diversification that it brings.