Fewer settings.

Better efficency.

Review the key changes, settings,

and updated T&Cs below:

We've simplified how you invest on Beehive.

Autobid is now streamlined to reduce complexity and increase efficiency, helping your funds work harder and support more SMEs.

Investment through Beehive involves financing to small and medium

sized businesses, so your investment can go down as well as up.

Fewer Settings.

Better Efficency.

We’ve upgraded how you invest on Beehive. A smarter, faster way to grow your returns.

A simpler way to invest

Everything you need to know for smarter autobid investing.

As a Beehive investor, you now have three decisive controls to define and refine your strategy.

Product split

Decide how your funds are split between Term Finance (TF) and Working Capital Finance (WCF).

Choose from:

70:30

50:50

30:70

Example:

If you have AED 100K and select 70:30, up to AED 70K can be allocated to TF, and AED 30K to WCF.

Business exposure

Set how much of your portfolio can be allocated to any single SME.

Choose from:

2%

3%

4%

Note:

Subject to a maximum of AED 360,000 per SME and minimum bid of AED 500.

*The percentage shown represents the portion of your total investment allocated to a single business.

Risk rating

Select which risk grades to include.

Choose from:

A+/A

B+/B

C

D

Note:

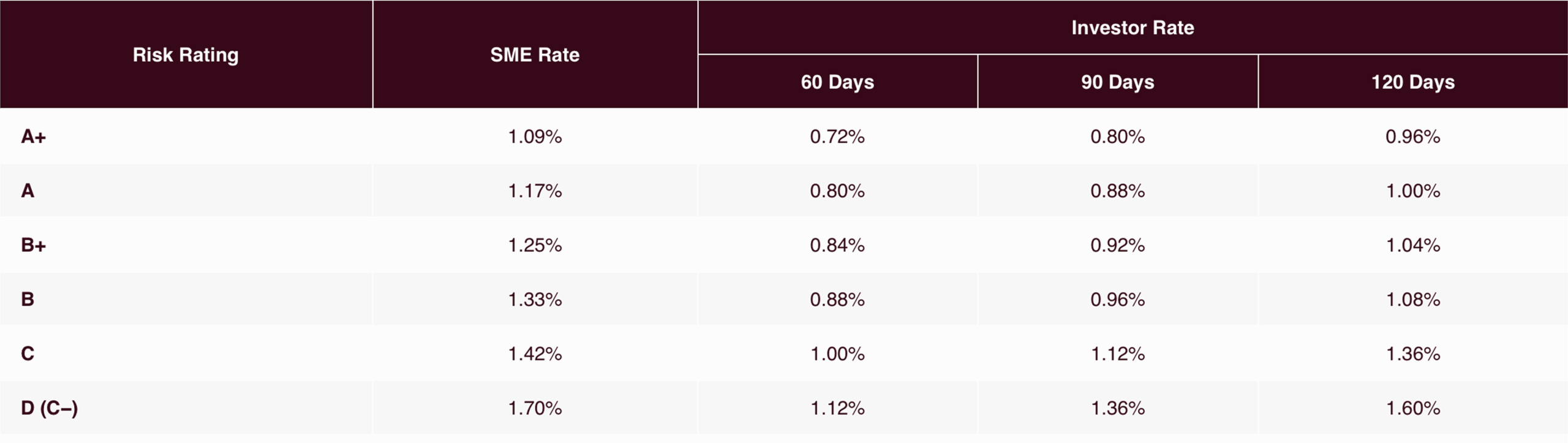

Return rates are unchanged. This setting applies to all products. Review the rates here.

Please note that both marketplace bidding and the transfer facility will be removed. All investments will be managed through Autobid.

We've simplified how you invest on Beehive

We’re transitioning to a simplified way of setting your investment preferences on Beehive. Starting September 22nd, Autobid will be streamlined to reduce complexity and increase efficiency, helping your funds work harder and support more SMEs.

A simpler way to invest

Everything you need to know for smarter autobid investing.

As a Beehive investor, you now have three decisive controls to define and refine your strategy.

Product split

Decide how your funds are split between Term Finance (TF) and Working Capital Finance (WCF):

Choose from:

70:30 (TF: WCF)

50:50 (TF: WCF)

30:70 (TF: WCF)

Example:

If you have AED 100K and select 70:30, up to AED 70K can be allocated to TF, and AED 30K to WCF.

Business exposure

Set how much of your portfolio can be allocated to any single SME.

Choose from*:

2%

3%

4%

Note:

Subject to a maximum of AED 36,000 per SME and minimum bid of AED 500.

*The percentage shown represents the portion of your total investment allocated to a single business.

Risk rating

Select which risk grades to include.

Choose from:

A+/A

B+/B

C

D

Note:

Return rates are unchanged. This setting applies to all products. Review the rates here.

The Marketplace will stay visible to all investors, but manual bidding will no longer be available.

Investors can still view all active bids, investments, and the businesses they’ve invested in, maintaining the same level of detail as before.

The Marketplace will stay visible to all investors, but manual bidding will no longer be available. Investors can still view all active bids, investments, and the businesses they’ve invested in, maintaining the same level of detail as before.

What you need

to know

Your preferences will automatically be matched as closely as possible to your current settings. If you haven’t yet set your investment preferences, your portfolio will automatically default to a balanced allocation: a 70:30 product mix, 2% exposure limit, and investments across the A+/A and B+/B risk brackets. You can review and adjust your preferences at any time after the transition. You may turn-off the autobid setting if you wish to accumulate funds but you cannot make new investments.

Review full T&C's

Frequently asked questions

Why are you removing manual bidding?

We’re focusing on a more scalable, consistent model. Autobid reduces idle cash and ensures a more even spread of opportunities for all investors, especially with growing demand and deal flow.

Can I still pick which business I invest in?

What if I haven't enabled autobid?

What if I don’t want these changes?

Can I choose my settings now?

Will my returns be affected?

| Rating | 12 months | 24 months | 36 months |

|---|---|---|---|

| A+ | 9.50% | 11.00% | 12.00% |

| A | 12.50% | 13.50% | 14.50% |

| B+ | 13.25% | 14.25% | 15.80% |

| B | 14.00% | 15.00% | 16.50% |

| C | 15.00% | 16.50% | 18.00% |

| C- | 17.00% | 18.00% | N/A |

| D | 19.50% | 21.50% | N/A |

Got more questions?

Got more questions?

Contact our dedicated support team at [email protected], call us at +971 4 550 6700 or Whatsapp us here.

Risk warning

The experienced credit team at Beehive rigorously assesses every application and only lists creditworthy, established businesses on the platform. Whilst we typically list established businesses, we may also list some early-stage businesses and lending to these may involve higher risks. You are lending to SMEs and need to be aware of the risk of default which could result in the loss of all or part of your investment. You may also experience delays in being repaid or may not be able to sell your loan using the transfer facility if you wish to do so. As a lender, you should decide on your own risk parameters and diversify investments to limit risk.

Find out more about our risk assessment here. The risk band classification we provide on a Business Funding request is only a guideline and you will need to evaluate the creditworthiness of a Business. Read more here. The financing contract will be directly between you and the Business. Beehive is not party to the contract and you make bids and financing on Beehive entirely at your own risk. Any bid you place will be final and binding unless certain conditions are met as set out in paragraph 6.3.6 in the Terms and Conditions for Investors. If in doubt, you should seek independent financial advice before placing any bid. In the unlikely event that Beehive ceases to exist, lenders may lose part or all of their money, incur costs or experience delays in being repaid.

The use of credit or borrowed monies to invest on a platform creates greater risk. For example, even if the Investment declines in value or is not repaid, the investor will still need to meet their repayment obligations.