Microfinance by

Beehive

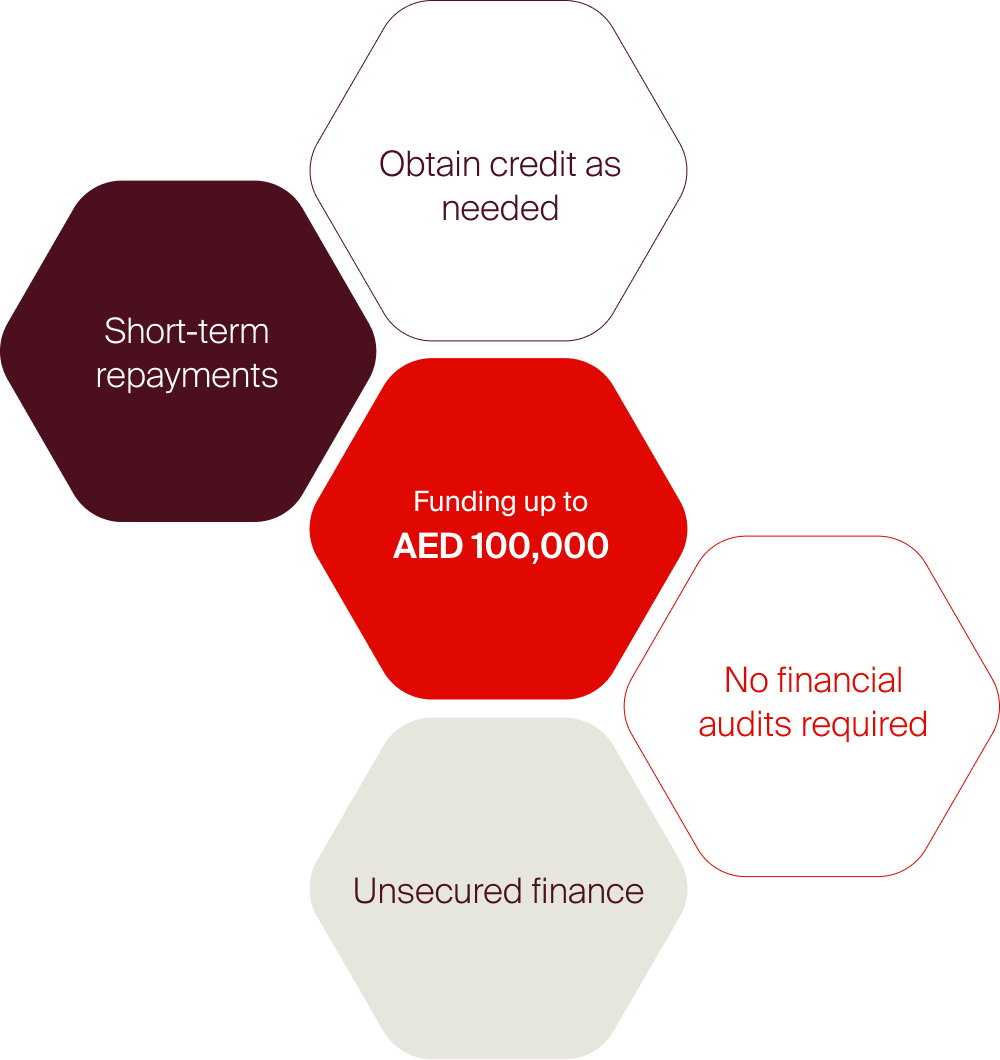

With easy-to-meet criteria, small businesses can get a fast cash injection with a fixed repayment amount.

What is

Microfinance?

Under this iteration of Business Funding, SMEs receive a lump sum of funding from investors and in return, commit to sharing a predetermined percentage of their future revenue over a specified period of time.

Microfinance is an innovative financing solution that offers SMEs an alternative avenue to finance.

Funds sourced through Beehive’s crowdfunding platform

SME Tenure:

3 or 4 Months

SMEs are offered the option of either a 3-month or a 4-month tenure

Flat Fee, No Compounding Interest

A single flat fee is applied, as opposed to compounding interest charges

Request Processing

in 48 Hours

Ability to process the request within 48 hours

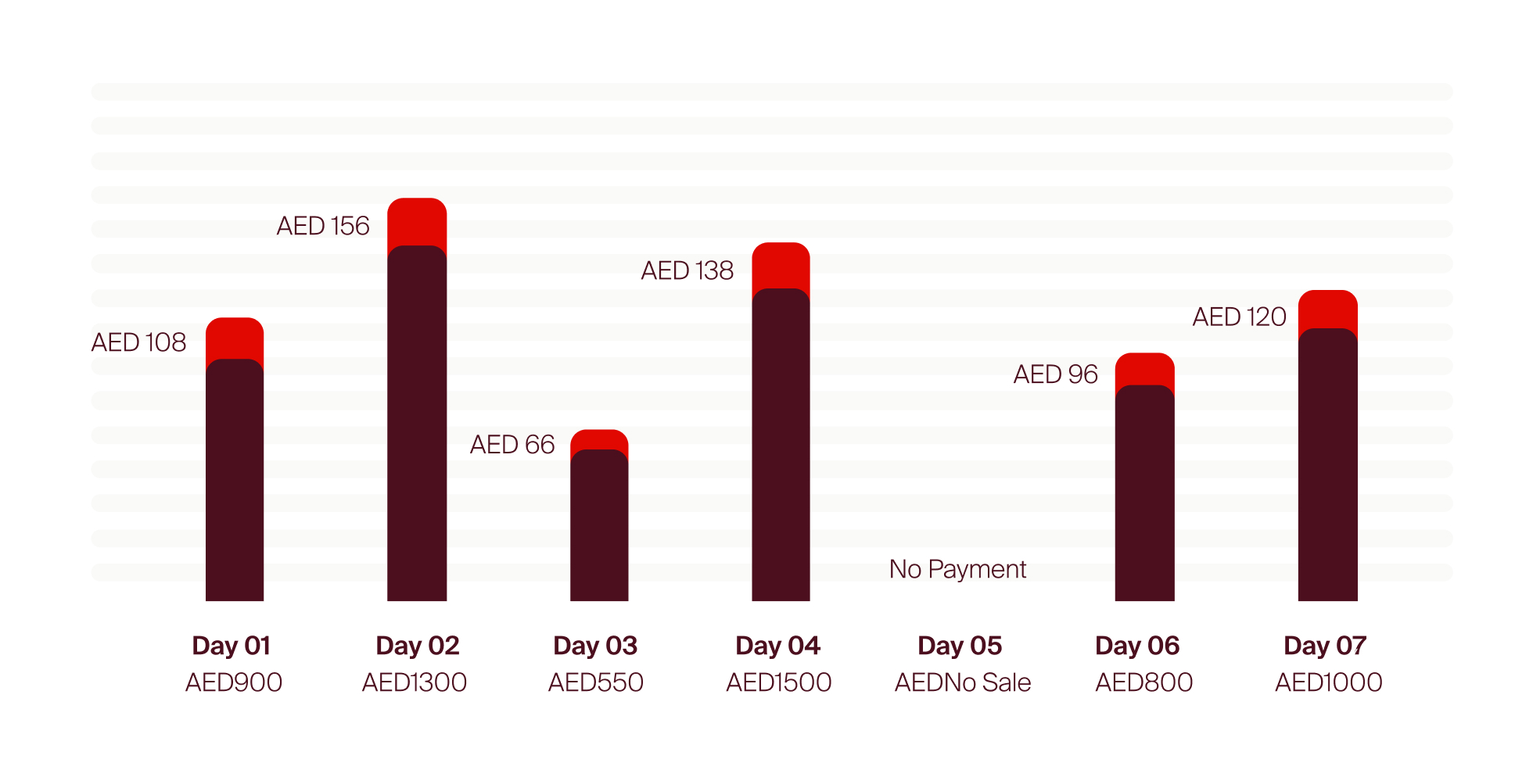

Daily Sales

12% of sales

repayment

Scroll to view all daily sales

How does it work?

Check your eligibility

Submit

Submit your request, and a Beehive representative will contact you to assist with completing the application process.

Success

Requesting Finance is Easy

Beehive.ae

For more details, contact the team at +971 4 550 6700 or email [email protected]

Risk Warning

The experienced credit team at Beehive rigorously assesses every application and only lists creditworthy, established businesses on the platform. Whilst we typically list established businesses, we may also list some early-stage businesses and lending to these may involve higher risks. You are lending to SMEs and need to be aware of the risk of default which could result in the loss of all or part of your investment. You may also experience delays in being repaid or may not be able to sell your loan using the transfer facility if you wish to do so. As a lender, you should decide on your own risk parameters and diversify investments to limit risk. Find out more about our risk assessment here.

The risk band classification we provide on a Microfinance request is only a guideline and you will need to evaluate the creditworthiness of a Business. Read more here. The financing contract will be directly between you and the Business. Beehive is not party to the contract and you make bids and financing on Beehive entirely at your own risk. Any bid you place will be final and binding unless certain conditions are met as set out in paragraph 6.3.6 in the Terms and Conditions for Investors. If in doubt, you should seek independent financial advice before placing any bid. In the unlikely event that Beehive ceases to exist, lenders may lose part or all of their money, incur costs or experience delays in being repaid.