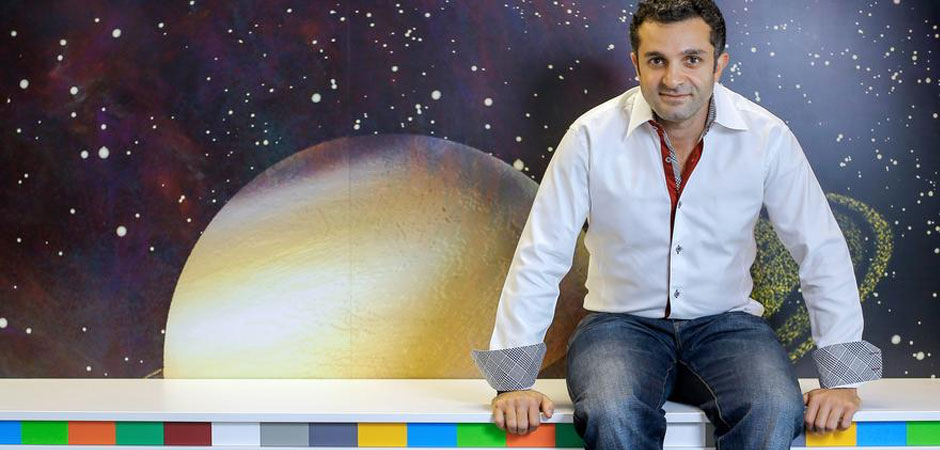

When Dany El Eid, a Lebanese-born entrepreneur, needed quick cash to fund his Dubai-based digital technology business Pixelbug he found the banks were offering him enormous rates of interest and a mountain of paperwork to get it.

By chance, he says, a financier he knew told him about an online company that links those who needed loans with investors, reducing the rate of interest for the borrower and increasing it for the lender. To boot, the company, Beehive, could get him the Dh200,000 he needed much quicker than the bank.

Instead of the weeks and months it can take to get a loan from a bank, Mr El Eid, said he got the loan in under 24 hours for the much needed cash to fund his company as it searches for longer term funding from venture capitalists – businessmen who take risky bets on start-ups.

“I was very fortunate, especially since Beehive had recently launched,” says Mr El Eid, 32, who founded the business in 2012 . “It came at the right time because we didn’t want to go to the banks. There is a lot of red tape and interest rates are through the roof and Beehive just allows us to have extra breathing space to manage cash flow as we close our funding round.”

Mr El Eid says that when he approached the banks, he was offered interest rates between 20 per cent and 26 per cent for a 12-month loan and would incur a penalty for early repayment. Instead, with Beehive, he was able to get a two year-loan at a rate of 14 per cent interest a year. And there would be no penalty for early repayment.

More and more small and medium sized businesses such as Pixelbug are cutting out banks in favour of cheaper online middlemen. These lenders are called peer-to-peer marketplace lenders, online companies that pair up those in need of debt with investors seeking to get a higher rate of interest than by leaving their money in the bank.

While peer-to-peer lending is not yet established in this part of the world, it is gaining traction in developed countries.

Late last year, the Lending Club, a San Francisco-based online lender, sold shares to the public in the biggest IPO for the industry, valuing the company at the time at more than US$5 billion. The global peer-to-peer lending market was valued at more than $9bn in 2014 and is forecast to grow to in excess of $1 trillion by 2025.

At stake is the monopoly banks have over financial services. Analysts say peer-to-peer lenders may create a more even playing field for consumers and businesses that need financing, especially at a time when interest rates across the developed world, including the UK, are near zero as central banks desperately try to stoke economic growth by keeping rates low.

While banks argue their clients want the kind of value-added services they can offer, such as a branch network and loyalty perks on credit cards, increasingly, no-frills banking is starting to proliferate in another blow to the big lenders that have been dogged by allegations of wrongdoing since the crash of 2008.

In the UAE, the peer-to-peer lending industry is still in its infancy – and faces huge challenges. The banking industry in this country is huge, where more than 50 lenders service a population of about 9 million.

Analysts say it will be a tough challenge for them to break the mould of the big lenders here – the country is overbanked and short on investors who may find peer-to-peer investment appealing.

“In theory it should make it easier for SMEs but I am not so sure it will work here because this market is so far behind,” says Vishnu Deuskar, the managing director at Salvus Advisors, a Dubai-base firm that advises SMEs.