A quarter that not only redefined the pace of our growth but also reinforced Beehive’s position as a pioneer in the digital SME lending space across the GCC.

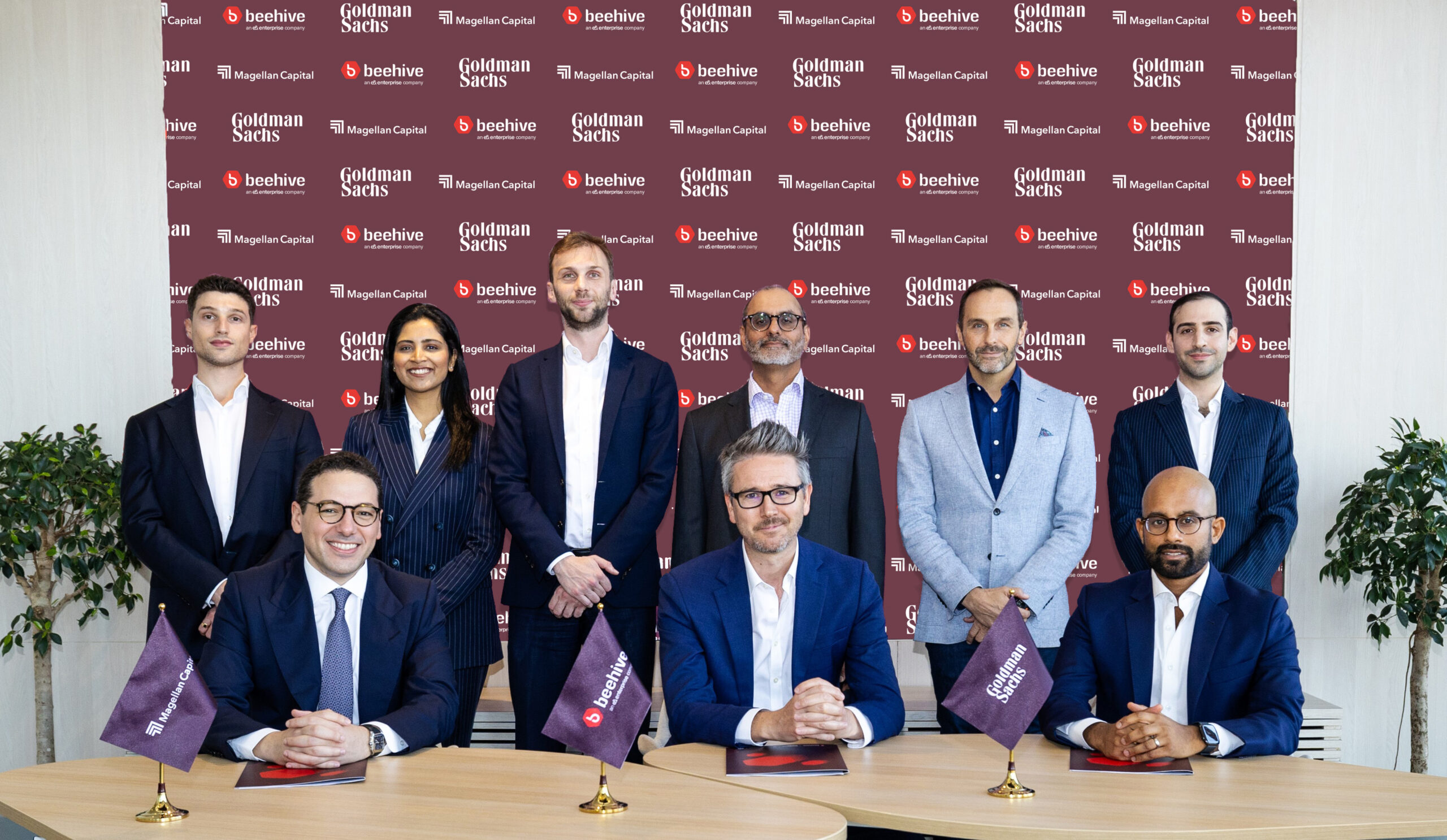

From securing funding alliances to growing our team and enhancing regulatory frameworks, Q1 was a testament to our mission: fueling the growth ambitions of SMEs through fast, digital and accessible finance.

Let’s look at what made Q1 remarkable:

Performance highlights: Impact in numbers

Our platform continues to make a tangible difference to real businesses. Through Beehive, we now have:

1500

across the GCC

1.5

Billion

AED

1.5

Billion

Secured in SME funding

10000

+

These aren’t just statistics; they’re stories of businesses growing, creating jobs, and realizing dreams.

We are heard and seen:

We’re thrilled to have been featured on multiple esteemed platforms, where we showcased our impact in connecting SMEs with investors:

People & Culture: Growing with Purpose

Behind every bold move is a team that believes in the mission. In Q1, we expanded our talent pool to ensure we’re always one step ahead in serving SMEs across the GCC.

Team Expansion Highlights:

-

UAE: Two new employees in Credit, two in business development, and one in Compliance. -

Oman: A new business development executive and country head who will lead operations. -

KSA: Three new business development executives and our first Credit Trainee.

What’s Next?

As we move into Q2, our focus remains clear: To be the lender of first resort for SMEs in the GCC and to continue enabling their growth in smarter, faster, and seamless ways.

Want to get funded by us?

In the UAE, Beehive P2P Limited, an e& enterprise company, is regulated by the DFSA. In Oman, Beehive Financial Technology SPC is regulated by the FSA. Beehive in KSA is registered as ‘Beehive Saudi for Technology & Information Systems’