As the SME financing landscape evolves, private credit is poised to play an increasingly prominent role. By leveraging their agility, flexibility, and innovative approach to lending, private credit providers can unlock the full potential of the $2.5 trillion* SME market, driving economic growth and creating value for all stakeholders involved.

Let us dive into the intricacies of the banking sector’s SME lending retreat, explore the factors that have led to this shift and the opportunities it presents for private credit providers.

The Banking Sector’s SME Retreat is a $2.5 trillion Treat for Private Credit

The financial sector’s ongoing reduction in lending to SMEs is gaining speed as global central banks tighten their balance sheets, a process that has sucked out trillions of dollars of liquidity from the financial system. That backdrop, paired with the tighter capital adequacy standards of Basel III, has further exacerbated the credit gap.

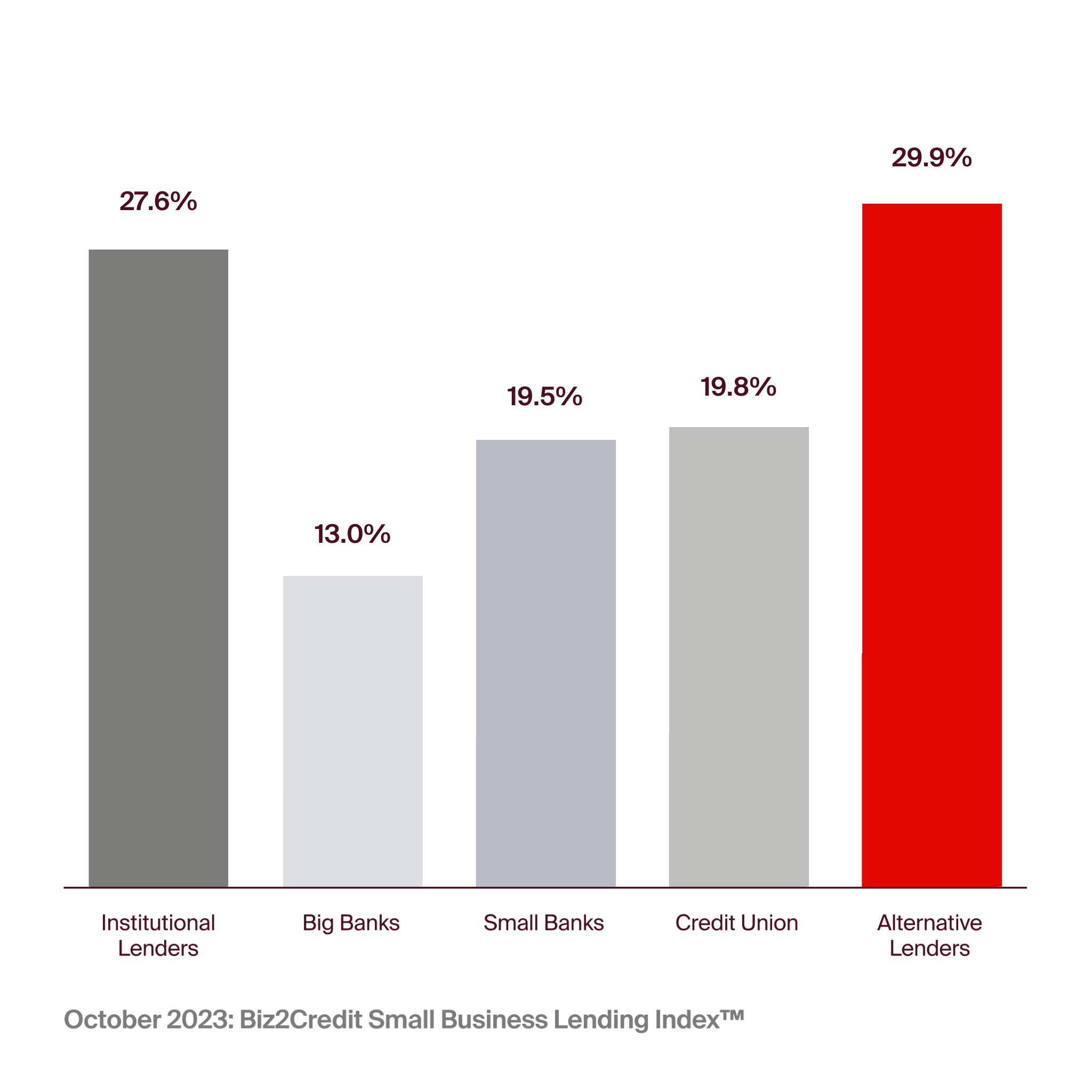

In the US alone (the largest private credit market globally), ~57% of SME lending originated from institutional and alternative lenders – with the banking sector accounting for ~32%.

If we focus on the lower end of the segment, this number declines to ~20%, which, according to market insiders, compares to a negligible 2% in the GCC region.

Sector-wise break up of SME lending across the United States

Source: https://www.biz2credit.com/small-business-lending-index

Small Business Loan Approvals Dropped at Big Banks, Rose at Small Banks, and Alternative Lenders in October 2023: Biz2Credit Small Business Lending Index™

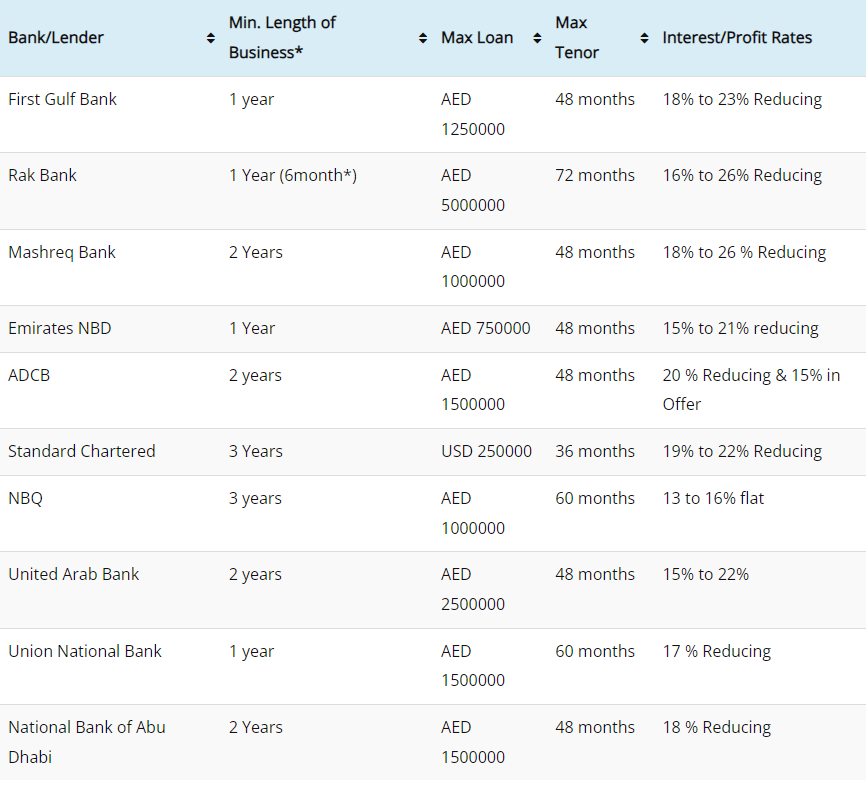

This disinterest by the banking space is reflective in the pricing levels offered by banks in the UAE – which when paired with the months of processing and approval times – further drives SMEs to private credit providers that are flexible, transparent, and efficient in their processes and pricing.

As investors weigh up their portfolio rebalancing for the new year, the continued abandonment of lending to this space from banks – paired with the continued rise of private credit platforms in the region, provide a strong tailwind to the asset class.

Nearly 40% of investors with investors surveyed by market intelligence service Preqin, expressed a ‘Positive’ outlook towards their allocations (i.e. either increasing or maintaining) in private credit going into 2024.

And what better place to achieve that goal than through Beehive?

Any questions?

Book a call with our Investor Relations team here

If you require more information, contact us at [email protected]